- Daily Gains

- Posts

- 🦉 BlackRock’s Ethereum ETF Rockets to $10B in 10 Days

🦉 BlackRock’s Ethereum ETF Rockets to $10B in 10 Days

Altcoin Season May Soon Set In Thanks To This Bitcoin Dominance Trend, Cryptocurrency ETFs Get A Boost From Government Cheerleading

GM 🦉 This is Daily Gains! Time for your latest crypto news in 5 minutes!

In Today’s Crypto World:

OWLGO’S NEWS NEST

3 TRENDING HEADLINES 💡

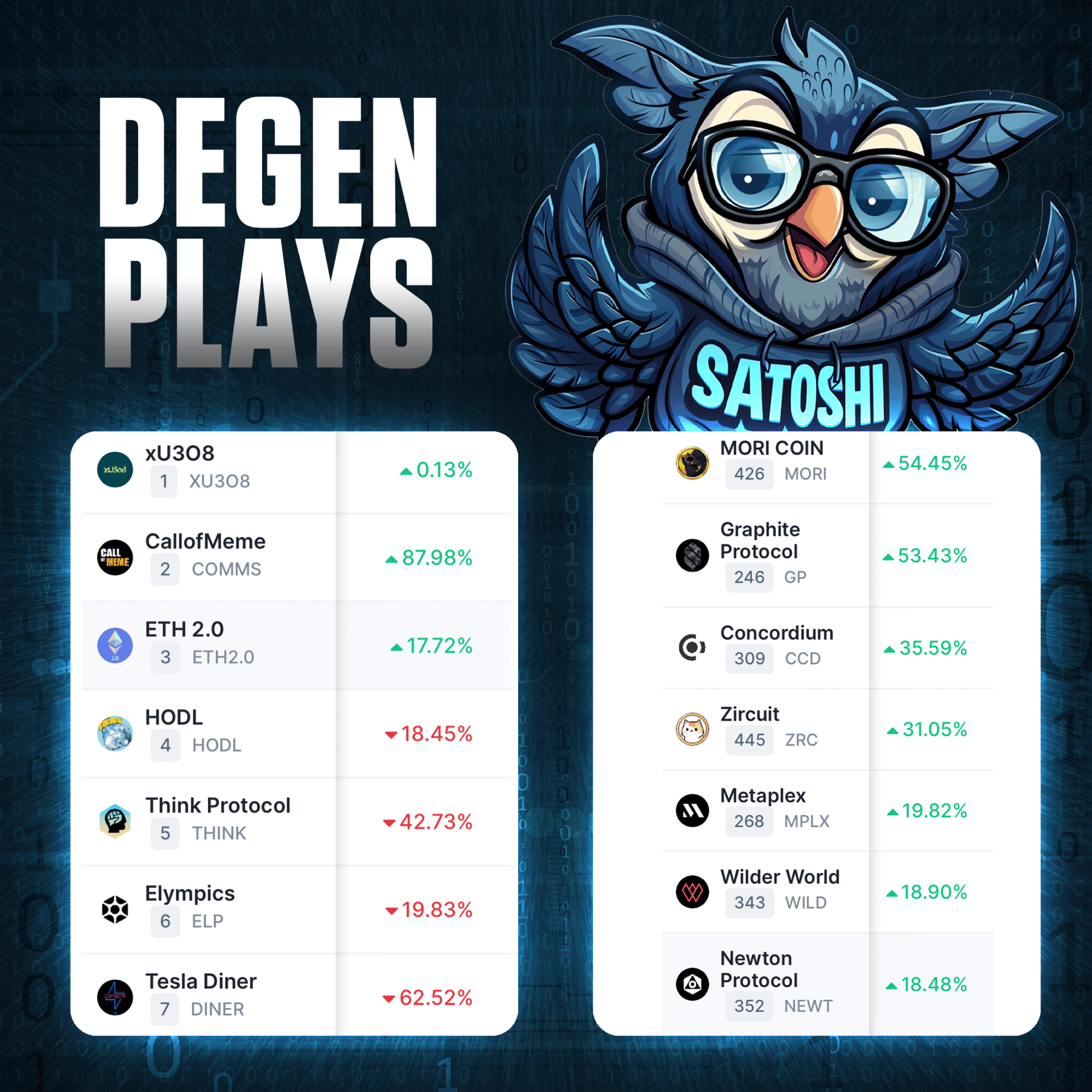

DEGEN PLAYS

GAINERS & NEWBIES 👀

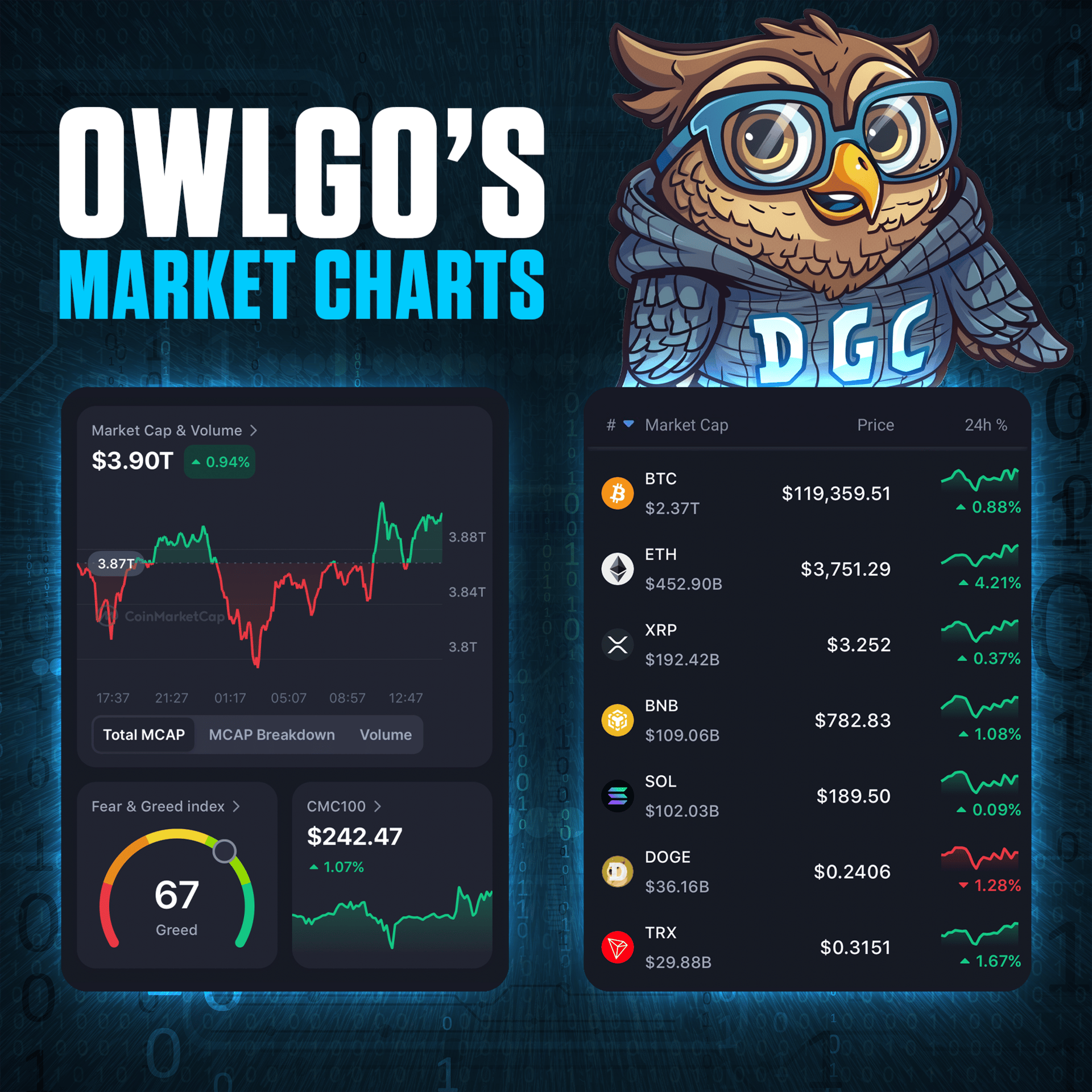

*Market insights are updated daily.

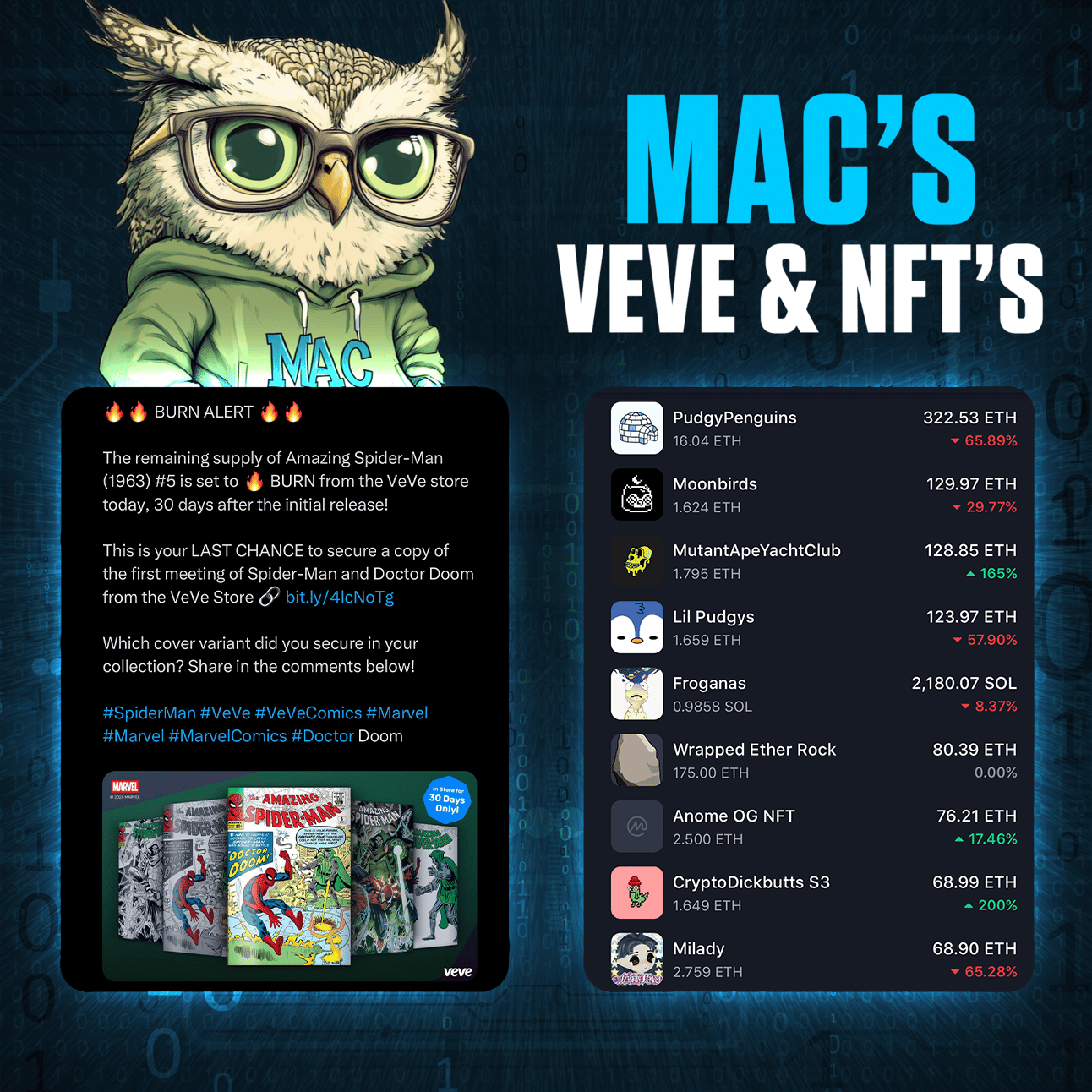

MAC’S VEVE & NFT

SPIDER-MAN BURN ALERT

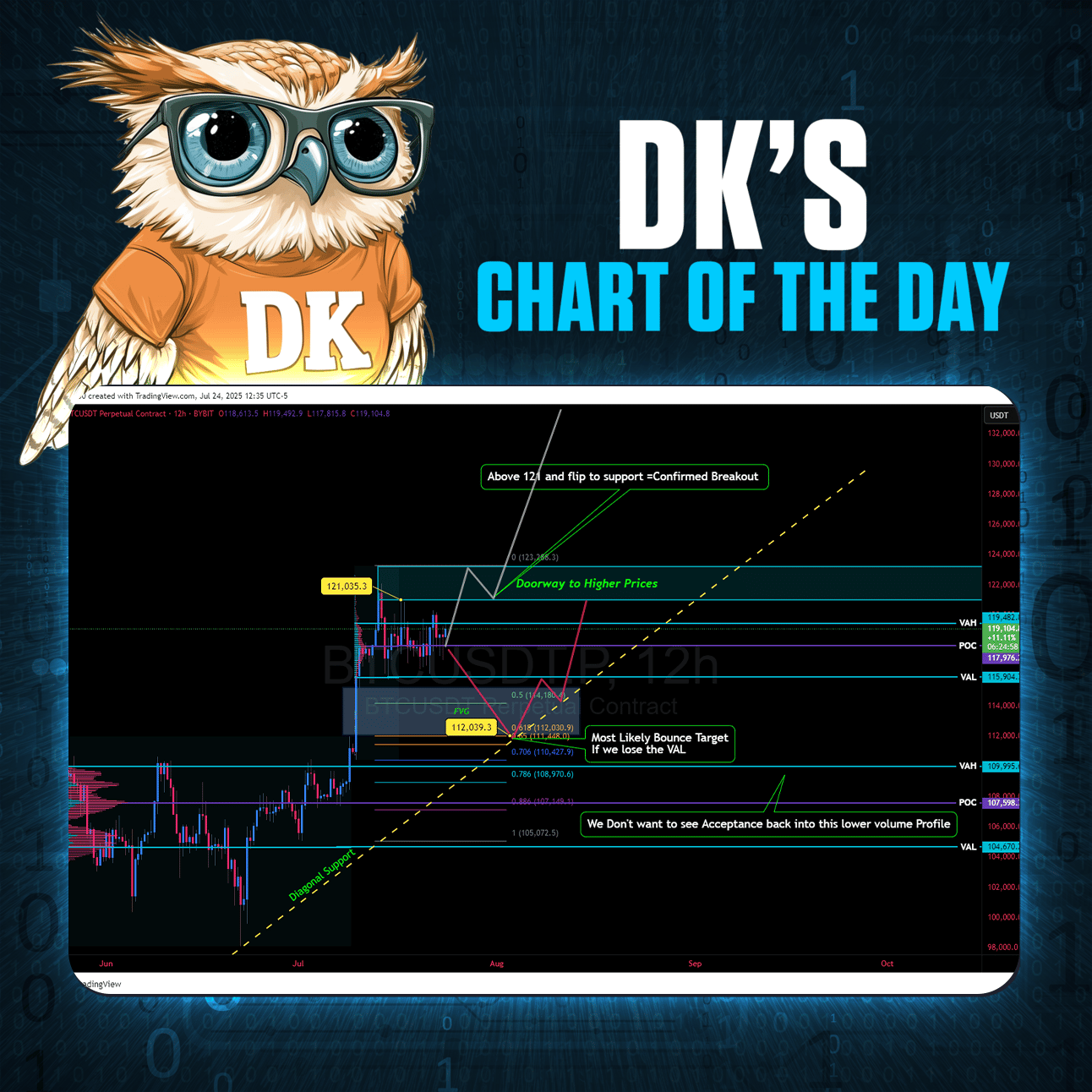

DK’S CHART OF THE DAY

BTC USDT PERPETUAL 12 HOUR 🔬

Chart by: www.tacticaltradinghub.com

After reaching an all-time high of $123,300 on Sunday, July 13th, Bitcoin has been range-bound, forming a local volume profile.

Value Area High (Top of Range): 119,500

Point of Control: 117,900

Value Area Low: 115,900

We’ve been trading sideways within this range ever since falling back into it on Monday, July 14th. My bias remains bullish for now, with an upside resolution still the most probable outcome.

To confirm a breakout, we want to see price reclaim the high from Thursday, July 17th at 121,000. If 121,000 flips into support, we should be on our way to new all-time highs. The zone between 121,000 and 123,000 is essentially our doorway to higher prices.

There is a clear buildup of liquidity under the range lows (from July 10 to now), and the most likely bounce zone, if we get a downside liquidity, sweep comes in at 112,000. That level offers strong confluence between the daily fair value gap, the golden pocket, Prior ATH/breakout level, and diagonal trendline support. Anywhere between 114,000 and 112,000 would be a valid bounce area, but 112,000 is the highest probability level due to that confluence.

If price tags that zone and bounces, that would still be a bullish scenario. What we don’t want to see is acceptance back into the lower volume profile, that starts at 110,000. That zone marked the prior range from early May through early July. If we fall back in and can’t reclaim 110K, we could be in for further downside and consolidation.

So the key levels:

Hold above 110,000

Break and hold above 121,000 = breakout confirmed

Clear 123,000 (previous ATH)

Next target out of this consolidation pattern is 131,500

The daily momentum oscillator is resetting, and I expect resolution from this consolidation in the next 24 to 72 hours.

Most probable scenario: Bitcoin reclaims 121,000, flips it into support, breaks through the previous all-time high at 123,000, and continues higher toward 131,500.

Second most probable scenario: A downside liquidity sweep into the 114,000–112,000 region, with 112,000 being the strongest bounce zone due to the fair value gap, golden pocket, and diagonal support confluence. That would still be a bullish setup as long as we maintain above 110,000.

Still bullish unless we lose 110,000 on a daily close and fail to reclaim it.

Join the Tactical Trading Hub Discord or follow across socials to stay updated.

Book a free consultation at http://tacticaltradinghub.com to get started. See you on the inside!

OWL’S EYE VIEW

CRYPTO VIDEO SPOTLIGHT - BITCOIN CHART NEVER WRONG 🔦

T’S HOOT’S OF ENLIGHTENMENT - IS ALTCOIN SEASON HERE?💡

Altcoin season is officially heating up in 2025. With Bitcoin holding strong above $110K and consolidating after its ETF-driven rally, capital is rotating into high-potential altcoins. Ethereum is leading the charge, buoyed by its spot ETF approval and Layer-2 scaling adoption. Meanwhile, Solana, SUI, AVAX, and meme coins like BONK and LILPEPE are exploding in price and volume—classic hallmarks of an altcoin surge.

Historically, altcoin season follows major Bitcoin rallies, once BTC dominance begins to decline. That’s happening now, with BTC dominance slipping below 52% and altcoin market caps climbing fast. Traders are shifting focus to mid- and low-cap coins with narrative momentum: AI, real-world assets (RWA), gaming, and modular blockchains are among the biggest winners.

As for how long it will last—altcoin seasons tend to span 2 to 4 months, though some cycles extend up to 6 months if macro conditions and sentiment remain strong. The 2025 cycle, powered by institutional capital and clearer regulations, could stretch longer than usual. However, volatility remains high, and sharp pullbacks are common. Savvy investors will take profits in stages and rotate tactically.

Bottom line: altcoin season is here—diverse, fast-moving, and potentially historic—but timing exits wisely is key.

Want to learn more? Join us today… www.dailygainscrypto.com

OWLGO’S HOOT BUZZ

OWLGO’S HOT X POST 🚀

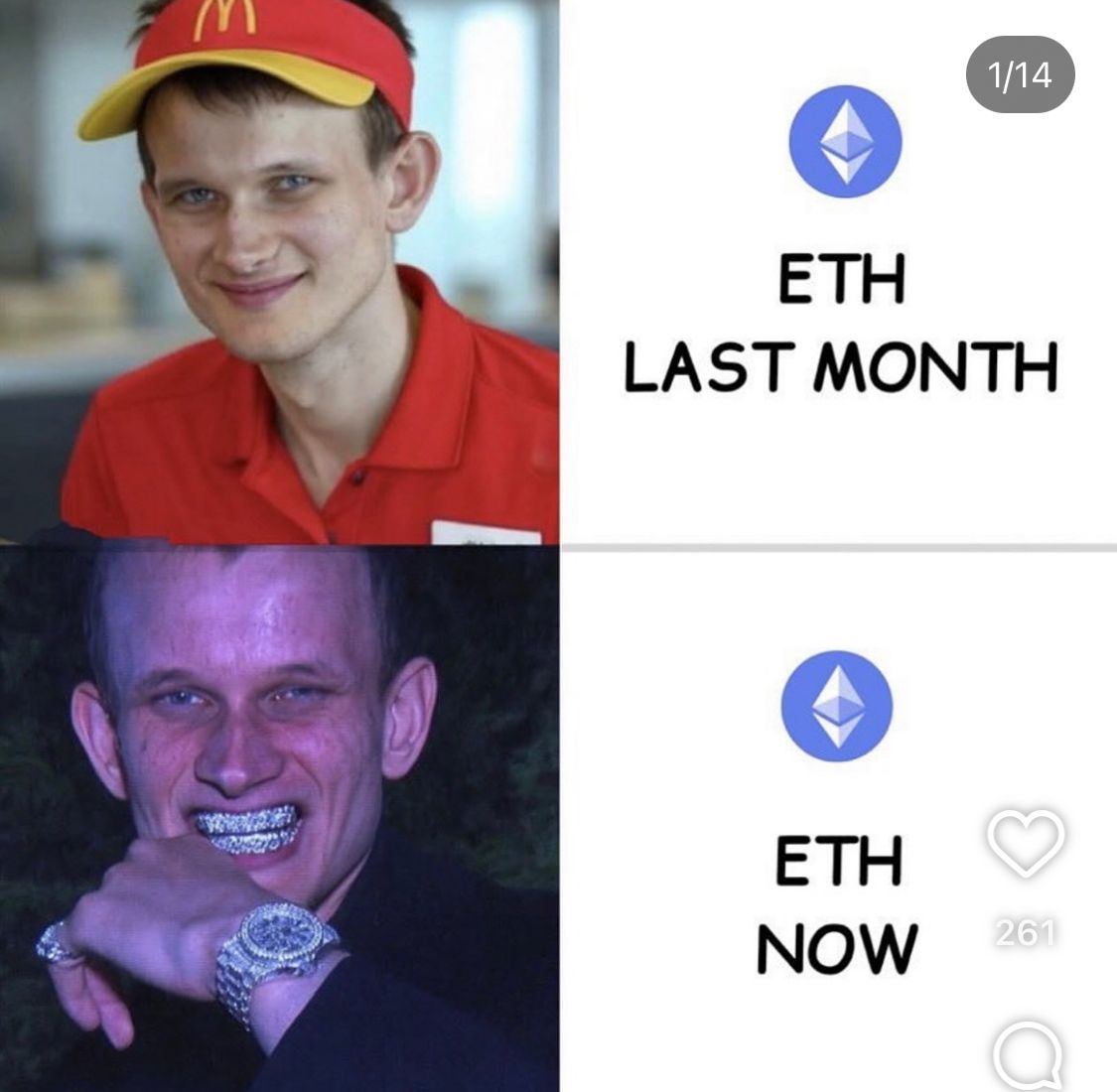

OWLGO’S LOLS

DAILY MEMES 🤣

Brought To You By: DailyGainsCrypto.com

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.